Featured

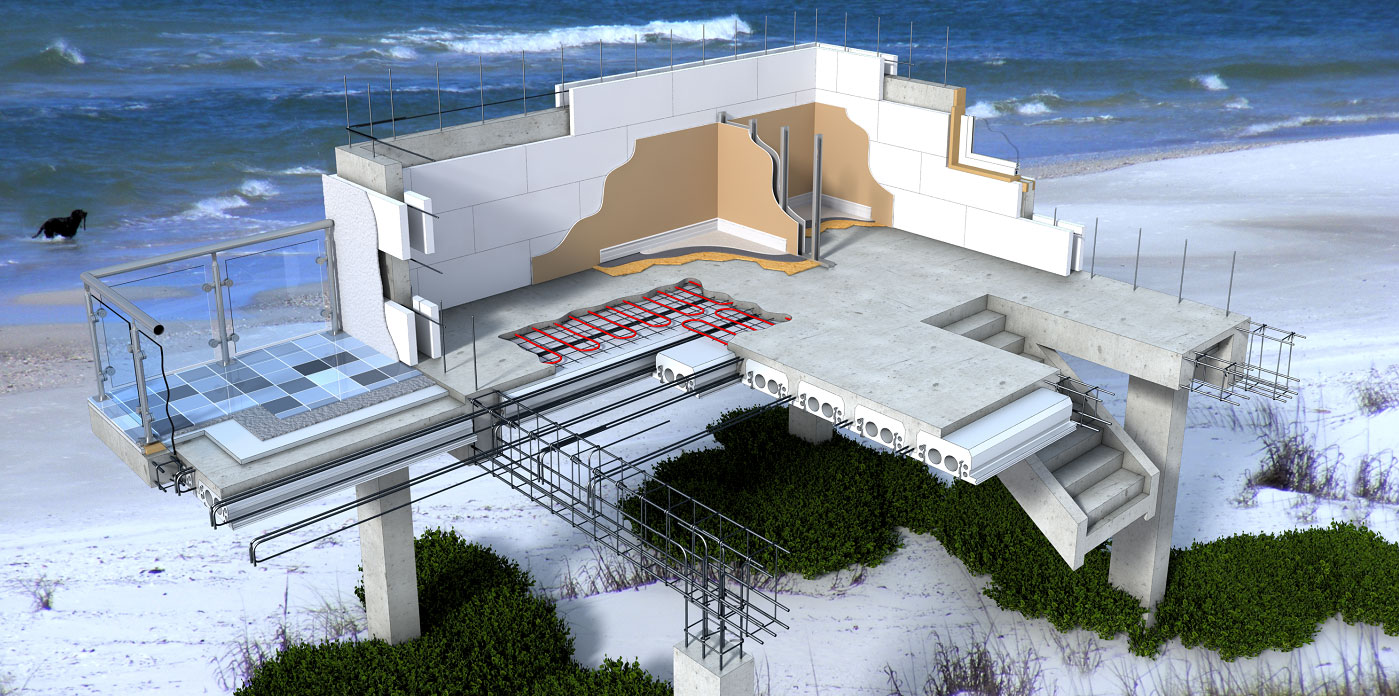

House Insurance For Flood Risk Areas

House Insurance For Flood Risk Areas. So just because a house may be a long way from. Our data shows that the average cost of a joint buildings and contents home insurance policy for a property within 400m of water is over £17 higher than for a property more than 400m from water.

Flood risk areas also come in a surprisingly different set of types including those at risk from sea or rivers, surface water, groundwater and reservoirs. An estimated one in five homes in the uk is at risk of flooding according to jba risk management, which assesses flood risk. There should also be information available about the extent of the flood risk.

Depending On The Extent Of The Flood Risk At Your.

The nfip provides flood insurance to property owners, renters and businesses, and having this coverage helps them recover faster when floodwaters recede. Flood damage is becoming ever more common. If you already have flood insurance and would like us to look at your current rate to see if we can find you a better one, we can do that.

I Understand Us Having To Pay A Bit Extra On The.

Our data shows that the average cost of a joint buildings and contents home insurance policy for a property within 400m of water is over £17 higher than for a property more than 400m from water. Contact the environment agency if your insurer asks for evidence of your flood risk. This guide aims to provide, in one place, information that will help you to obtain a suitable policy.

To See If Your Own Home Is At Risk From.

The cost of home insurance with flood cover varies, depending on how close you live to water. This is to discourage people from building homes in high flood risk areas. Get evidence of flood risk.

Flood Risk Areas Also Come In A Surprisingly Different Set Of Types Including Those At Risk From Sea Or Rivers, Surface Water, Groundwater And Reservoirs.

It's an agreement between the government and uk insurers, including admiral, which allows us to offer more affordable insurance for areas most at risk of flooding. If there’s somewhere between a 1 in 100 and a one in one thousand chance of your property suffering flood damage then your area is considered to be low risk. An estimated one in five homes in the uk is at risk of flooding according to jba risk management, which assesses flood risk.

Flood Re Is Funded By An Annual Tax That Is Collected From Uk Home Insurers.

Be prepared to pay more. The scheme will also make it easier for people to replace or repair their property if. Basically, it means a large amount of water overflowing beyond its normal limits over dry land.

Comments

Post a Comment